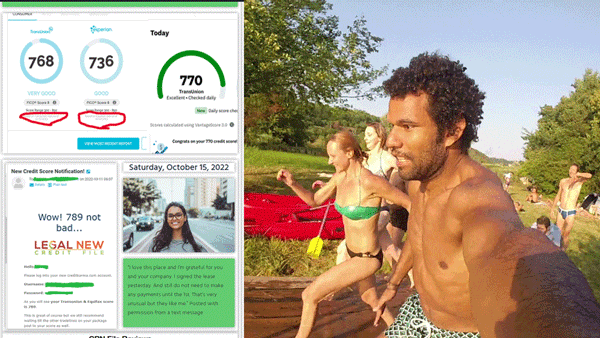

✨ Start Over with 740+ Scores! 🎁

With your New Credit File, you can get:

- 🌟A New Apartment or Rent a House

- tradelines posted in 3-5 days!

- 💳 Credit Cards & 🚗 Auto Loans!

- ✨ Your CPN can help with Building Business Credit and Getting Premium Phones Without Deposit! ✨

- 💡 OPTIONAL: Register Your CPN with the IRS for additional benefits!

- 🌈 Rebuild Your Future & Protect Your Privacy!

What is a CPN? Having a Credit Privacy Number is Legal In All U.S. States. A CPN Number is a 9 digit number that can be used in lieu of your social security number for credit reporting. This is a 100% legal way of obtaining new credit.

GET

A 2ND CHANCE

Laws, Policies and Procedures change frequently in the Credit Privacy Industry.Whether we are talking about CPN Numbers (Credit Privacy Numbers), Credit Repair, Debt Relief, Bankruptcy, CPN Number Tradelines, CPN Packages, Credit Privacy, Personal Loans, Auto Loans or Renting an Apartment with a CPN.

Laws, Policies and Procedures change frequently in the Credit Privacy Industry.Whether we are talking about CPN Numbers (Credit Privacy Numbers), Credit Repair, Debt Relief, Bankruptcy, CPN Number Tradelines, CPN Packages, Credit Privacy, Personal Loans, Auto Loans or Renting an Apartment with a CPN.

The intricacies of managing a clients financial situation is a sensitive matter, requiring trusted professionals with experience to help guide the way.

OUR PROCESS OF GENERATING A LEGAL NEW CREDIT FILE IS TIME TESTED. WE KNOW YOU DONT WANT TO LOOSE TIME OR MONEY!

LET’S START AGING YOUR NEW PRIVACY FILE OR BUSINESS TODAY.

For many years our specialists have created strategies for a clients credit growth depending on their given circumstances. Ask about connecting your new CPN Number to a New or Established Business as the Personal Guarantor to triple your available credit potential.

I got in touch with them with so much positives in my heart and just as I hoped, they got the job done within 3weeks...

I'm excited about this because the problems I had due to my original low credit score has been a burden on me all this while especially me being a father of two girls. We thank you!"

Build on a CPN Number with confidence. Be responsable with your new credit file!

Our service fee covers all your business startup costs, includes 30 services in one, 12 incredible bonuses, and we handle all the work for you!

CPN PACKAGES - CPN NUMBERS - CPN NUMBER - CPN SOFTWARE - CPN NUMBER GENERATOR - CPN FILE - CPN GENERATOR SOFTWARE - CPN PACKAGES - How Can I Get A CPN Number For Free - Create CPN Number - Creating CPN Number

CPN Number

Introduction

Create a new credit history by getting a Legal CPN Number

When you get a CPN number, it can be used to build your new credit history. A CPN number is not the same as a Social Security number, but it does serve the same purpose: helping you establish a new credit identity and credit score.

Once you have a CPN, you’ll be able to apply for new services such as utilities or cell phones that require good financial standing. You can even open up bank accounts without having any previous history!

- Understanding CPN Usage

- The Legality of CPNs

- Acquiring a New SSN Legally

- Frequently Asked Questions

- What is a CPN number?

- Can using a CPN improve my credit score?

- Is it legal to get and use a CPN?

- How do I acquire an SSN legally if I need one?

- What steps can I take to protect myself from CPN fraud?

- Why might someone want to use a CPN instead of an SSN?

- What exactly does “Understanding Credit Privacy Numbers (CPNs)” mean?

- Reasons for Utilizing CPNs

- Understanding Credit Privacy Numbers (CPNs)

Ever wondered what a CPN number could mean for your credit report, payments, accounts, and loan journey? It’s a concept wrapped in curiosity and, at times, confusion.

In the bustling world of credit and finance, understanding every tool available, including legal cpns, can be the edge you need.

A CPN number stands as one such tool—shrouded in mystery but with potential to open doors if understood correctly and linked to a credit report.

This post aims to demystify this enigmatic figure and explore its place within personal finance management.

Navigating through the labyrinth of credit scores, applications, and approvals can seem daunting. But knowledge is power—and that’s especially true.

Let’s dive into the reality behind CPN numbers: their purpose, legality, and how they fit into the broader picture of fiscal responsibility.

Exploring CPN Fundamentals

CPN Defined

A Credit Privacy Number or CPN is a nine-digit ID number. It looks like an SSN. People use it mainly for credit matters.

But, unlike Social Security Numbers, the government does not issue CPNs.

CPNs are for individuals seeking privacy in their credit transactions.

They serve as a shield against identity theft and fraud. Yet, they’re not a free pass to avoid past debts or bad credit history.

Some think of a CPN as a fresh start for their financial profile. However, this belief can lead to misuse and legal issues if not understood correctly.

CPN vs SSN vs ITIN

The differences between these numbers are significant:

- An SSN is for U.S citizens and residents.

- An ITIN, which stands for Individual Taxpayer Identification Number, helps non-resident aliens file taxes.

- A CPN, while it can be registered with services like legalnewcreditfile.com, is neither an SSN nor an ITIN.

Each number serves its unique purpose:

- The SSN tracks lifetime earnings and benefits eligibility.

- The ITIN allows tax payments and processing by those without an SSN.

- The CPNs are intended strictly for protecting one’s credit information.

It’s essential to note that only SSNs and ITINs are recognized federal identifiers.

Functionality

CPNs act as placeholders in certain credit-related situations where you would typically use an SSN:

- They cannot be used when looking for work unless your employer 1099’s your EIN that is connected to your CPN Number

- Government forms will still require your actual social security number like when LegalNewCreditFile.com registers your CPN with the IRS (HERE).

Celebrities might use them to keep their personal details private due to public exposure risks associated with fame.

Financial institutions have varied policies on accepting these numbers; some may accept them while others may reject them due to the potential risks involved.

Despite its uses, you must remember that a CPN won’t replace your legal obligations tied to your real social security number.

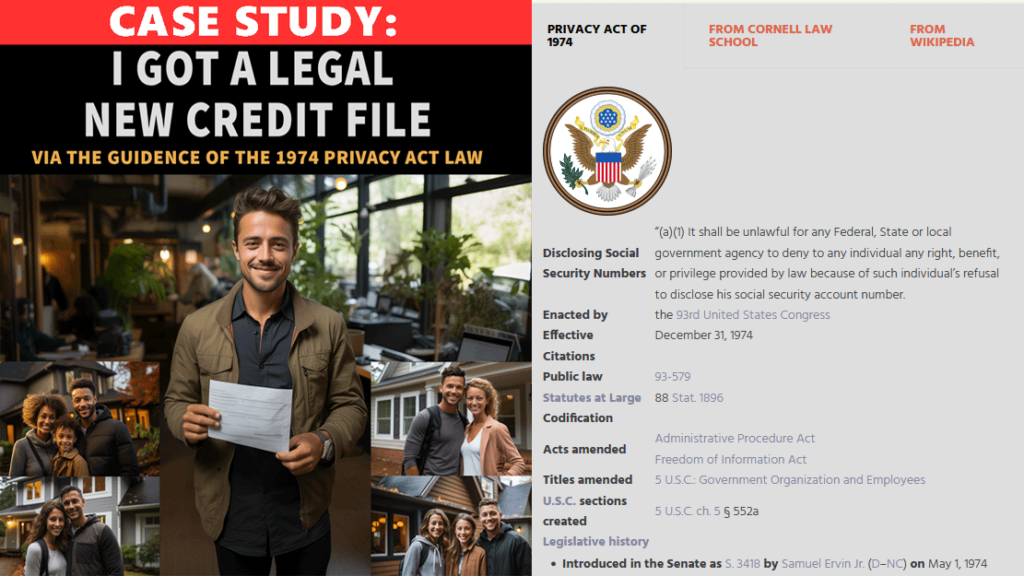

Origin and Legitimacy

Origin and Legitimacy

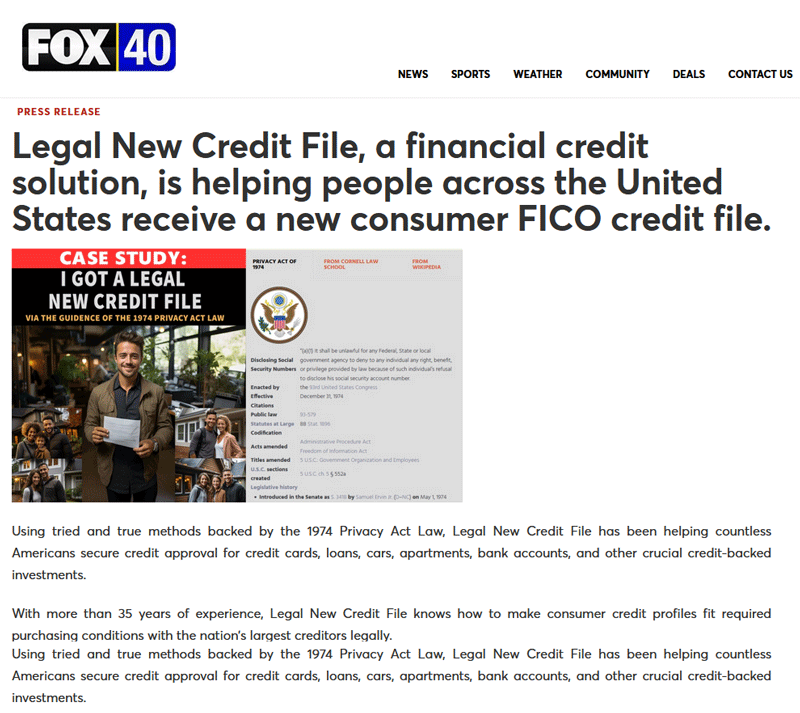

The idea behind the creation of the Credit Privacy Number was noble – protect people’s privacy from being compromised through their financial dealings.

| Public law | 93-579 |

|---|---|

| Statutes at Large | 88 Stat. 1896 |

| Codification | |

Disclosing Social Security Numbers “(a)(1) It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual’s refusal to disclose his social security account number. Enacted by the 93rd United States Congress Effective December 31, 1974

These numbers often pop up in conversations about improving one’s credit score quickly—usually marketed by companies promising quick fixes..

Misunderstanding what a CPN Number truly represents could lead someone down risky paths including identity fraud charges if the entity you source the number from took it from someone elses SSN profile and merged new data with it then sold it to you.

Understanding CPN Usage

Purpose of CPNs

CPNs, or Credit Privacy Numbers, are often presented as a way to start over with one’s credit history. They’re marketed to those who seek a clean slate. The idea is that by using a CPN instead of your Social Security Number (SSN), you can maintain privacy on your credit reports.

These numbers are sometimes used in situations where an individual prefers not to disclose their SSN. For example, when applying for an apartment lease or utilities services, some might opt for a CPN for privacy reasons.

CPNs help prevent identity theft. This belief stems from the notion that by limiting the use of one’s SSN, there’s less chance it can be stolen and misused.

Lastly, individuals looking for new credit opportunities may see CPNs as an attractive option. These numbers can allow them access to credit which they might otherwise be denied due to past financial issues.

- Marketed as fresh starts

- Intended for more private credit reporting

- Used in place of SSNs occasionally

- Believed to protect against identity theft

- Sought after by those wanting new credit chances

Reasons for Utilization

The desire to hide poor credit scores drives many towards using a CPN.

Some view it as creating distance from their financial pasts.

Starting fresh financially is another strong motivator behind choosing a CPN Number. It offers hope.

There’s also an attraction because people see it as a quick-fix solution—especially appealing in our fast-paced society where long-term strategies often take second place to immediate results.

Many users lack awareness about legal implications tied with using these numbers improperly or fraudulently.

People don’t always realize that while using a CPN might seem like bypassing negative history.

Here are several reasons why people consider utilizing a CPN:

- To mask low credit scores.

- To symbolically start anew financially.

- Because they want quick solutions.

- Thinking they can just walk away from old debt.

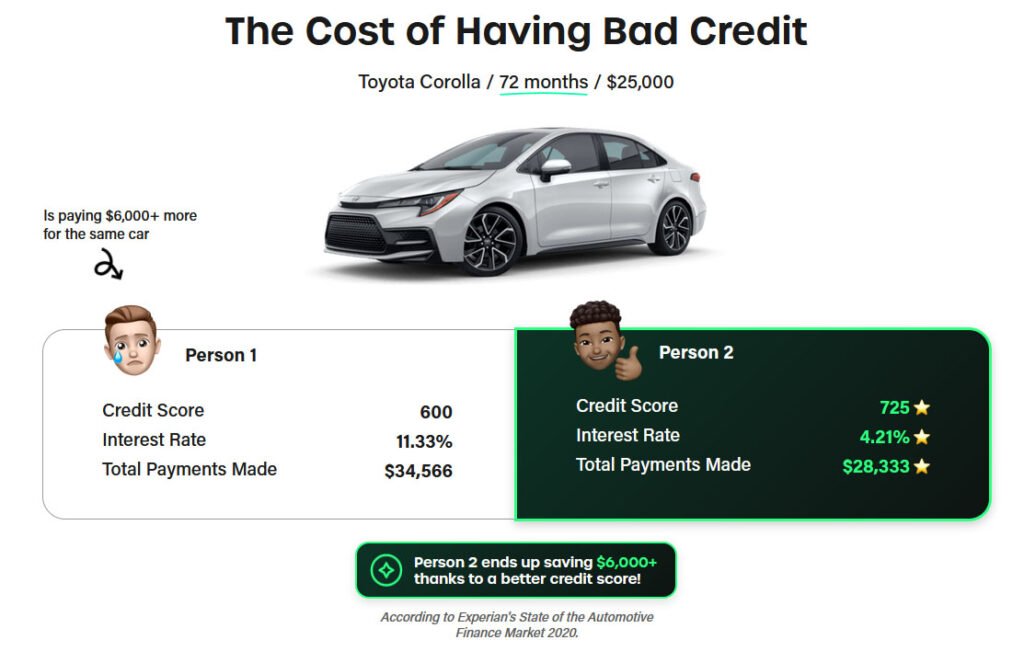

Improving Credit Scores

Even if someone decides on taking up a CPN, building good credit still demands time and effort—the same principles apply just like with traditional SSNs.

Regular payments made on time and responsible usage remain fundamental practices in improving any kind of score attached to one’s name—be it linked with an SSN or CPN Number alike.

Ethical practices should stay at the forefront when attempting any form of improvement regarding personal finances—including managing lines of credits associated with either type number system being discussed here today: social security versus consumer privacy ones (CPNs).

In order words:

- Good habits must continue even under different identifiers such us Consumer Privacy Number (CPN).

- On-time payments plus sensible spending habits boost all sorts of scoring metrics regardless what identifier gets used initially during setup processes.

- Ethics matter immensely across entire spectrum concerning fiscal management tasks undertaken willingly each day around the globe universally without exception. Respect your accounts and they will respect you.

The Legality of CPNs

The Legality of CPNs

Legal Concerns

CPN numbers, or Credit Privacy Numbers, are often surrounded by controversy.

Legal issues arise when they’re misused. For instance, using a CPN that belongs to someone else is outright fraudulent.

It’s important to know that you don’t have to give out your Social Security Number (SSN) all the time. There are situations where not disclosing your SSN is perfectly legal and within your rights.

However, there are valid scenarios for using CPNs. They can serve as a shield for privacy in certain financial transactions. But these cases are specific ask LNCF for the details at legalnewcreditfile.com .

Using a CPN instead of an SSN must be done properly to avoid legal trouble.

Remember, just because disclosure of your SSN isn’t always required doesn’t mean you can use a CPN without understanding the risks involved.

LNCF provides you all the legal documents in any situation to either use your CPN Number or multiple other legal documents to provide any counterparty in any situation you arrive at.

Obtaining Legally

Some private companies claim they can legally issue CPNs if used correctly. However, this area is murky at best and demands thorough investigation before proceeding.

If considering obtaining a CPN number from such sources:

- Perform extensive due diligence.

- Understand what you’re signing up for.

- Be wary of companies promising quick fixes or those who lack transparency about their processes.

The website https://legalnewcreditfile.com provides consulting professionals when dealing with credit matters involving alternative identification numbers like CPNs.

They recommend ensuring any company offering such services follows strict guidelines and adheres to lawful practices regarding credit reporting and lending laws.

Before getting involved with any service claiming to provide legal issuance of a CPN Number:

- Check their track record.

- Look into customer reviews carefully.

- Consult with experts who understand the nuances of credit law thoroughly.

Acquiring a New SSN Legally

Feasibility of New SSN

Obtaining a new Social Security Number (SSN) is not an everyday occurrence. Rare circumstances may warrant such a drastic measure. The criteria set by the Social Security Administration (SSA) are stringent. One must provide convincing documentation and proof to be considered.

For example, victims of identity theft who face ongoing financial harm despite remedial efforts might qualify for a new number. Similarly, those in situations where their life is in danger, like domestic violence survivors, could also be eligible.

Before attempting this process, it’s crucial to consult SSA guidelines thoroughly. They outline the acceptable reasons for issuing a new SSN. Remember that these cases are extreme and exceptions rather than the rule.

Legal Process Overview

When considering acquiring a new SSN legally, understanding relevant laws is vital. Familiarize yourself with fair lending practices governed by federal law. These rules aim to ensure fairness and transparency in credit transactions.

The Fair Debt Collection Practices Act protects consumers from abusive debt collection tactics. It’s essential to know your rights under this act when dealing with creditors or collections agencies. Legal New Credit File (LNCF) offers a Credit Repair Service you may find interest in HERE.

Moreover, stay aware of your legal responsibilities when engaging with creditors. Ignorance can lead to unintended violations of agreements or regulations.

Keeping up-to-date with consumer protection legislation changes is also important as they can impact your rights and obligations significantly.

Avoiding Illegal Alternatives

Trust established companies over unverified entities that lack credibility and proper accreditation; doing so will protect you from potential scams or legal repercussions associated with illicit activities.

Final Remarks

Navigating the world of CPN numbers can feel like a tightrope walk between legality and necessity. You’ve seen how CPNs can be both a shield against identity theft and a sword that cuts through privacy. They’re not a one-size-fits-all solution, but for some, they’re a pivotal step towards financial discretion. Remember, the law’s clear: legitimacy is key. If you’re eyeing a fresh start with your credit, do it by the book to stay clear of fraud’s sticky web.

Take charge of your financial story. Seek legitimate avenues into the CPN pool. Your credit’s more than a number—it’s your ticket to opportunities. Protect it. Grow it. And if you’re ever in doubt, reach out to a trusted financial advisor. They’ve got your back so you can stride forward with confidence.

LNCF staff are Attorneys-in-fact as well as legally standing fiduciaries to guide you down the Credit Privacy route.

Frequently Asked Questions

What is a CPN number?

A CPN, or Credit Privacy Number, is a nine-digit identification number that some individuals use in place of their Social Security Number (SSN) for credit-related purposes.

Can using a CPN improve my credit score?

No, a CPN is not an SSN. Genuine SSN improvement comes from responsible financial habits and time. CPN’s are methods to create a seperate credit file with a separate credit score.

Is it legal to get and use a CPN?

The legality of CPNs is complex; while they are not illegal per se, their usage can be fraught with legal issues. It’s vital to stay informed and source your CPN Number from a trusted source.

What ways can I take to protect myself from CPN fraud and credit report scams by monitoring credit bureaus?

Stay vigilant by researching thoroughly before engaging with any service offering CPNs. If something seems too good to be true, it likely is. Trust official sources only like LNCF.

Why might someone want to use a CPN instead of an SSN for a cleaner credit report or to separate their financial accounts and payments?

Some people may seek privacy from identity theft concerns or use a CPN to help them start fresh financially.

What exactly does “Understanding Credit Privacy Numbers (CPNs)” mean?

It means gaining knowledge about what CPNs are intended for, how they operate within the financial system, and recognizing both the potential misuses and misconceptions surrounding them.

Reasons for Utilizing CPNs

Privacy Protection

CPNs, or Credit Privacy Numbers, offer a layer of privacy. They are nine-digit identification numbers that can be used in place of a Social Security Number (SSN) for some credit transactions. This means your SSN stays private.

People often use CPNs to shield their SSN from exposure. When you apply for credit with a CPN, your SSN is not on the application. This reduces the risk of identity theft.

A real-life example is when someone moves to a new city and wants to keep their personal information secure. A CPN can help them establish services without giving out their SSN.

Credit Repair Tool

Some individuals turn to CPNs as they work on fixing their credit scores. A poor credit history can limit opportunities and increase stress.

Using a CPN might allow these individuals to start fresh with financial institutions. It’s like getting another chance at building good credit from scratch.

However, it’s essential to know that using a CPN does not erase bad credit history linked to an individual’s SSN. We always recommend getting a CPN number while you fix your credit HERE.

An example here would be someone who has gone through bankruptcy seeking new ways to rebuild their financial standing without being immediately penalized by past mistakes.

Business Endeavors

Entrepreneurs sometimes use CPNs when setting up business-related finances separate from personal ones. This separation helps maintain clear records and limits personal liability.

For instance, if someone starts an online store, they might get a business loan under a CPN rather than risking personal assets tied up with an SSN.

This practice ensures that any debt incurred doesn’t affect the entrepreneur’s personal credit score directly.

The following link can give you access to a new business with a CPN that can act as a personal guarantor HERE.

Understanding Credit Privacy Numbers (CPNs)

Legal Status

Credit Privacy Numbers, or CPNs, are often surrounded by confusion regarding their legality. It is crucial to recognize that while CPNs themselves are not illegal, the misuse of these numbers can lead to unlawful activities. For example, using a CPN to go but a car and drive away never intending to make good on the loan.

Any way you look at it that is theft no matter if you used an SSN, CPN or any other identifier.

Obtaining a CPN

To obtain a legitimate CPN, one must follow specific steps through proper channels. The process typically involves filing paperwork with state or federal agencies that offer these identifiers for certain situations. LNCF acts as an intermediary helping you with the paperwork.

It is important to avoid services promising quick fixes or instant credit improvement through CPNs. Many such offers are scams preying on those desperate for financial solutions. Always research thoroughly before proceeding with any service claiming to provide legal CPNs.

Public records alone take 10-14 days to marinate into the nations databases.

Using Your Number

Once obtained legally, it’s essential to know how and where you can use your new number appropriately.

- A valid use case could be protecting your SSN from exposure in public records.

Understanding the scope and restrictions associated with using a Credit Privacy Number will help ensure you stay within the bounds of the law while seeking privacy protection.

Risks Involved

Fraud Potential

The potential for fraud is high when dealing with entities promoting illegitimate uses of Credit Privacy Numbers. Scammers may encourage individuals to start fresh financially by misusing these numbers as part of so-called “credit repair” schemes which can lead users into deeper legal trouble rather than solving their problems.

LNCF reports that 82% of companies they have tested services with like trade lines and traditional CPN support services have resulted in tens of thousands of research and development funds lost while reviewing companies to help secure their support foundation for their clients needs.

CPN Explained: Legality, Risks, and Credit Alternatives

- Understanding CPNs

- CPN Legality

- CPN Misuse and Scams

- The Role of LNCF

- Alternative Credit Solutions

- CPN and Identity Theft Risks

- Legal Aspects of CPNs

- Rebuilding Credit Responsibly

- Differentiating CPNs, ITINs, SSNs

- Final Remarks

- Frequently Asked Questions

Eight out of ten consumers haven’t heard of a CPN, yet it’s a concept that could redefine the financial system and personal credit as we know it. In the bustling financial landscape, understanding what a CPN is and how it operates can be like finding your way through an intricate maze—challenging but not impossible. This blog post strips away the complexity surrounding CPNs, giving you the lowdown in plain English.

We’re diving into the nitty-gritty without any fluff. Whether you’re a consumer trying to navigate credit options or simply curious about alternative financial tools, this post will equip you with essential insights on CPNs—what they are, how they function, and why they matter in today’s credit-driven world.

Understanding CPNs

CPN Definition

A Credit Privacy Number (CPN) is an identification number. It can be used in place of a Social Security Number (SSN) for credit transactions by consumers and children.

The main role of a CPN is to protect personal information. When you apply for credit, lenders often require an SSN. A CPN offers another option here. This helps keep your SSN private.

Celebrities and public figures use CPNs most often. They do this because their personal info might be at risk more than others’. But remember, using a CPN doesn’t mean you can ignore debts or legal duties on your SSN.

Intended Use

CPNs are made for maintaining privacy in financial matters. They help people like actors, politicians, victims of abuse and anyone needing a second chance to guard their identities when they handle money issues.

These numbers are specifically aimed at those who need extra privacy measures due to their status as public figures or high-profile individuals who may have increased security concerns.

It’s key to understand that the purpose of a CPN isn’t to avoid paying debts or escaping from any legal responsibilities one might have under their actual social security identity.

SSN Protection

Using a CPN helps prevent overexposure of your Social Security Number in various situations where credit-related activities occur, thus reducing the risk associated with personal data breaches.

This kind of protection shields against potential misuse by third parties who could otherwise gain unauthorized access to sensitive information through less secure channels.

CPN Legality

Legal Status

CPNs, or credit privacy numbers, are not created by government bodies. They are a subject of much confusion and often mistaken for being legally recognized like Social Security Numbers (SSN). CPN’s are not SSN’s.

Government agencies do not issue CPNs. This fact is crucial to understand.

Always keep in mind:

| Disclosing Social Security Numbers | “(a)(1) It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual’s refusal to disclose his social security account number. |

|---|---|

| Enacted by | the 93rd United States Congress |

| Effective | December 31, 1974 |

| Citations | |

| Public law | 93-579 |

| Statutes at Large | 88 Stat. 1896 |

Ethical Considerations

There’s ongoing debate around the morality of using CPNs. People argue for privacy and protection against identity theft.

The use of CPNs raises questions about credit transparency. When individuals use them instead of their real SSNs while applying for credit or loans, lenders don’t get accurate information about their credit history.

This lack of transparency can lead to ethical concerns regarding fair access to credit opportunities:

- Lenders might unknowingly offer credit based on incomplete information.

- Individuals with good intentions but poor financial histories could misuse these numbers.

- Others who have been victims of identity theft might seek out these numbers as an alternative solution rather than going through proper channels for resolution since the system is set up for it to be very difficult for anyone with a high school education to ever be able to legally represent their status and standing to force a creditor to produce a true bill. LNCF does it for you HERE.

CPN Misuse and Scams

Recognizing Fraud

CPNs, or Credit Privacy Numbers, have legitimate uses. However, fraudulent activities often surround them. One major sign of a scam is the promise of a new credit identity using someone elses SSN profile number and it gets sold to someone else with new data and the unsuspecting victim finds out the hard way they have a bad CPN.

Make sure you get a CPN from a company that can register the number with the IRS HERE.

Avoiding Scams

It’s critical to stay vigilant about who you’re dealing with.

Firstly, verify any provider’s legitimacy before engaging their services

Understanding what CPNs legally can and cannot do will also protect you from being deceived:

- Knowledge: Know legal uses versus myths around CPNs.

To avoid scams:

- Confirm provider credibility through research.

- Educate yourself on lawful applications of CPNs.

The Role of LNCF

Legal Registration

Obtaining a CPN legally involves specific steps. You must go through the proper channels.

First, understand a CPN is used in certain financial situations.

You can only get a job with a CPN if you register it with the IRS and your employer 1099’s your EIN on your CPN.

Now, let’s talk about registration. To get a CPN, you’ll need a new email address and a new phone number. You need to get a prepaid phone or contract phone from one of the 4 major carriers and not use a VOIP phone number like a burner app.

Register for a Legal New Credit File HERE.

If you try and apply for a credit card with a burner phone app or a google voip voice number you will not be approved for credit.

Advanced Packages

Some services offer more than just a CPN; they provide credit repair too HERE.

Alternative Credit Solutions

Credit Improvement

Building a solid credit history is key for financial stability. Credit scores reflect this. A CPN, or credit privacy number, must be respected as well as the accounts obtained with it to ensure a long life of your new accounts.

Responsible financial behavior is the true path to better credit. This includes paying bills on time and managing debts wisely.

Legitimate methods for improving your score are clear-cut with any number SSN, CPN, DUNs etc:

- Regularly check your credit report for errors.

- Pay down existing debt.

- Keep old accounts open to show a long history of credit use.

These steps lead to real results over time, regardless of credit identifier.

Identity Theft Safeguards

Identity Theft Safeguards

A false sense of security from using a CPN might make one care less about their data security. Yet, remaining vigilant with personal information is always important—even with a CPN in use.

Here are ways to keep your identity safe:

- Shred sensitive documents before throwing them away.

- Use strong passwords online and change them regularly.

- Monitor bank statements and look out for any strange activity.

Remember, protecting personal details should be ongoing regardless of any alternative solutions used.

CPN and Identity Theft Risks

Scam Indicators

Credit Privacy Numbers, or CPNs, can be a tool for privacy. One red flag is the promise of instant credit fixes. Legitimate processes to improve credit take time. Quick fixes are often not real. CPN public records take 10-14 days to marinate in the nations databases. See HERE.

Your credit history cannot simply be erased; it’s linked with your Social Security Number (SSN), not a CPN.

We always recommend you use a CPN while you repair your credit HERE.

Be wary of unsolicited offers too. If someone reaches out offering a CPN without you asking, it’s likely a scam. These offers may come via email, phone calls, or online ads.

- Instant solutions are suspect.

- Unsolicited CPN offers tend to be scams.

- For example did you call Legal New Credit File or did they call you? Correct, you called them.

- Consumer confidence is high with LegalNewCreditFile.com since they have been in business for many years, they do not need to cold call or spam.

Victim Protection Tips

Victim Protection Tips

LNCF staff are Attorneys-in-fact as well as authorized Fiduciaries in CPN management with solid data and client protection policies in place.

Stay protected when dealing with Credit Privacy Numbers by using a trusted company:

- You reduce risk of becoming victimized by scams,

- Help safeguard your financial health,

- Maintain control over personal information integrity within today’s digital landscape where data breaches occur frequently but prevention remains possible through education awareness efforts alongside practical action steps outlined above!

Legal Aspects of CPNs

Credit Repair Rights

When tackling the topic of credit privacy numbers (CPNs), it’s critical to understand consumer rights. The Fair Credit Reporting Act (FCRA) lays down laws that protect individuals. These laws are in place to ensure fair and private handling of personal credit information.

Understanding your rights is key when exploring credit repair options.

Identity Theft Costs

The impact of identity theft goes beyond just money lost—it affects lives deeply. Financial losses from such crimes are often huge, draining bank accounts and racking up debts. But there’s more than just cash at stake here—victims suffer emotionally too. The stress and time spent untangling fraud issues take a toll on well-being.

Misuse of a CPN ties into broader concerns about identity security raised in previous discussions on “CPN and Identity Theft Risks.

Rebuilding Credit Responsibly

Traditional methods to protect your Social Security Number (SSN) are still going strong. A Credit Privacy Number (CPN) is used for this. By keeping an eye on your credit reports, you can catch fraud early. This helps stop identity theft in its tracks.

Regular monitoring is key. Check your credit report at least once a year. It’s free and it shows all the credit activity under your name. If something looks wrong, report it right away.

Building or fixing your credit can be done through well-known ways too. Pay bills on time, keep balances low, and only open new accounts when needed. These steps help improve your score over time.

Credit System Safeguards

Credit System Safeguards

The credit system needs accurate IDs for everyone who wants credit. This means using real info is crucial when applying for loans or cards.

Thats why getting a photo ID (not a license) can be obtained for use with a CPN profile.

Fill out the application with all your regular SSN data on the DMV application and replace your home address with the CPN home address so credit issuers and other agents providing property or automobile access can verify your identity as it will match you CPN credit profile data this way.

More info HERE.

Differentiating CPNs, ITINs, SSNs

Distinguishing Features

A CPN (Credit Privacy Number) has unique traits. These separate it from an SSN (Social Security Number) or an EIN. Knowing these features is crucial. It helps you stay within the law.

Firstly, a CPN’s format can look like an SSN’s but serves different purposes. A CPN is for protecting your SSN in certain transactions. An EIN can identify a business partnership that was created between the CPN and the IRS. See CPN IRS Registration HERE.

Secondly, only the Social Security Administration issues valid SSNs. In contrast, private companies may provide CPNs to individuals seeking privacy.

Lastly, while an EIN is public information tied to businesses, both CPNs and SSNs are confidential (CPN EIN connection does not cross contaminate a CPN file or merge the data).

Awareness of these points prevents misuse of numbers in financial dealings.

System Safeguards Impact

Safeguards are vital for protection against fraud involving identification numbers like SSNs and CPNs alike. These measures help maintain trust in our financial system’s integrity.

Final Remarks

Navigating the world of CPNs can be like walking through a maze—you need to know the right turns to avoid dead ends and pitfalls. We’ve unpacked the nuts and bolts of CPNs, from their legality to their potential for misuse.

Identity theft risks and the importance of rebuilding credit responsibly should be top of mind.

Ready to get your credit back on track? Call legalnewcreditfile.com

So lace up your sneakers and hit the ground running towards a brighter financial future. And hey, if you ever feel lost, reach out for professional advice—there’s no shame in asking for directions on this journey.

Frequently Asked Questions

What is a CPN?

A CPN, or Credit Privacy Number, is a nine-digit identification number that can be used instead of a Social Security Number (SSN) to protect your SSN.

Is using a CPN legal?

Using a CPN for credit purposes is not illegal.

How are CPNs misused?

CPNs are frequently misused in scams by numbers being sold to victims that are actually another persons SSN. Make sure the CPN company can validate the number is not someone elses SSN, a dead persons or a babies.

Any legitimate company can easily prove to you the number is not on the live SSN or death master file index.

What’s the difference between CPNs, ITINs, and SSNs?

CPNs are numbers sold for protecting your SSN; ITINs (Individual Taxpayer Identification Numbers) are tax processing numbers issued by the IRS; SSNs (Social Security Numbers) are identifiers issued by the U.S. government.

SSN’s were issued under your trust name when you were a baby without your permission and your trade identity was sent through the U.S. mail which establishes a moral, legal and lawful controversy between multiple parties.

Are you already a victim of identity theft?

Buy a CPN Number

Introduction

How many times have you tried to open a new credit card or get a loan, only to be denied because you don’t have a good credit history? If this has happened to you, then this information is for you!

You will receive your CPN within 24 hours after payment.

We guarantee that you will be satisfied with our product. Most people are so happy with their CPNs that they order one for their friends!

A CPN number is a 9 digit number that can be used in lieu of your social security number for credit reporting. This is a 100% legal way of obtaining new credit.

You do not need to have a SSN to get a CPN, and it’s much easier than trying to apply for an actual loan or line of credit.

There are 4 reasons why you should get a CPN:

You want to apply for new lines of credit, but don’t have an established credit history yet because you’ve never had any lines open before (or they’ve all been closed).

You’re looking at bankruptcy and need a second chance while your bankruptcy resolves.

Someone stole your identity, so now there’s no way for you to get any loans or credit unless you can prove who you are through some other means besides your Social Security Number..

You will receive your CPN within 24 hours after payment.

The minimum turnaround time is 24 hours, but it can take up to 48 hours for the CPN number to be issued and sent via email.

You will receive an email confirmation when your CPN has been issued, and another with your new CPN number is attached to your new email address.

Our CPNs are guaranteed to be the best quality available. We stand behind our product and guarantee that you will be satisfied with your purchase.

Create a new credit history by getting a CPN

When you get a CPN number, it can be used to build your new credit history. A CPN number is not the same as a Social Security number, but it does serve the same purpose: helping you establish a new credit identity and credit score.

Once you have a CPN, you’ll be able to apply for new services such as utilities or cell phones that require good financial standing. You can even open up bank accounts without having any previous history!

Conclusion

We hope that you found this article helpful, and that it has given you a better understanding of how and why to get a CPN number. If you have any questions or concerns, please feel free to contact us at. We will be happy to answer them as best we can!

Origin and Legitimacy

Origin and Legitimacy

The Legality of CPNs

The Legality of CPNs

Identity Theft Safeguards

Identity Theft Safeguards Victim Protection Tips

Victim Protection Tips

Credit System Safeguards

Credit System Safeguards